Cash Offer Vs Financing Offer

There is a lot of conflicting advice on the topic. Should you make a cash offer vs financing offer for real estate investing?

When you start researching this with your own situation in mind, things will make sense while the heated debate fades to the background. Essentially, it all boils down to the factors at play. Each investor’s situation is unique in terms of finances available and investment goals.

We are in a seller’s market. Plus, institutions are getting tighter as they ask for more qualifications than before, while private lenders are surging to opportunities as many experienced investors have been hoarding cash or liquidatable assets.

In this light, we look at the factors for each scenario and provide clear insight into the possible risks and rewards. The decision is then up to you between cash offer vs loan offer.

LET’S START WITH REAL ESTATE FINANCING

Leveraging is the term used because, in theory, taking a mortgage should pay itself back by the rental income. While the mortgage is shrinking, the income grows. You have in effect, used other people’s money to increase, or leverage, your wealth.

Facts in favor of this method:

A Bigger Investment Opportunity:

When buying rental property this way, you can take out more than one mortgage. Say 2 or three. Instead of taking all your cash and buying one property, you can take the same amount of money and use it as down payments on more than one property.

Owning more than one rental property inflates your returns, as well as your equity. As rentals come in, your profits grow. As your mortgages shrink, your equity increases. If true of one, imagine this by multiple properties. Depending on the market’s supply and demand, we have seen most homes appreciate in Central FL at an average annual rate of 6%. When a property appreciates, your investment inflates, as your down payment was originally made on a lower value, overseeding the economy’s inflation level.Tax Write-Offs:

Mortgage interest is deductible against your rental income. Along with depreciation, your tax savings could be significantly more than had you bought the property using cash.

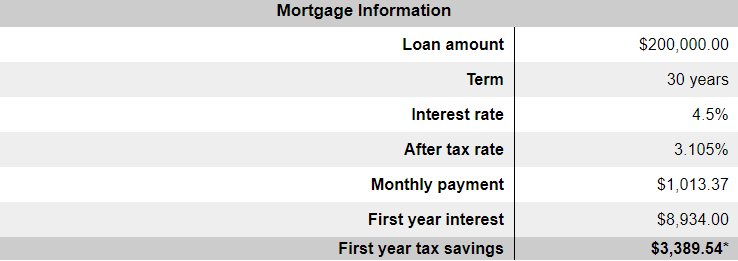

Using this mortgage tax deduction calculator, here are the results on a $200,000 mortgage note:

Cash-On-Cash returns are higher:

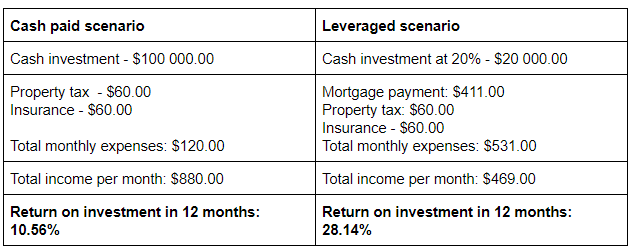

Admittedly, with leveraging, from the first rental income you have the expense of a mortgage payment added to property taxes and insurance. But look at it from the vantage point of having used a down payment as opposed to paying the entire value of the house as a lower cash investment.Home value: $100,000.00

Monthly rental assumed at $1,000.00 per month

Considering that your tenant is basically paying your mortgage, a 28.14% return is not bad at all. Now, if you have more than one property, this return increases by the amount of property you own.

Tips for Managing Risk:

With real estate financing comes obvious risk factors, so be savvy and do your homework.

- Never assume that property will appreciate the way you expect it to. Get a realistic forecast and always consider the worst-case scenario against your real estate financial situation.

- Mortgage options with lower down payments result in higher monthly installments. Remember that cash flow is important in making a success – if your payment is consistently higher than your income, you will eventually find the risk higher than the return.

- Always evaluate the properties and ensure that you are not paying more than you should since the financing was available.

- Listing with a property management company will minimize the risk of poor paying tenants, and ensure your property is being cared for at all times.

Remember, our experts are available on call to help you figure out the finer details!

NOW THE SCENARIO OF A CASH REAL ESTATE OFFER

For those with the cash power to invest in property with all associated risks, there are some big benefits.

Should the investment be your entire savings or retirement money, you may not be in the position of investing in rental property. There would be obvious risks involved.

Let’s discuss some benefits of using your own money to finance property investment.

Better Cash Flow from the start:

Obviously, as already demonstrated in the table above, the money starts coming in with the first tenant and does not have to cover any debt. There will always be expenses associated with renting out your property, so not having to cover payment is a sure benefit.

Should you hit times where your property is unoccupied, or tenants cannot cover the rent, there will be less of a loss of investment than in the case of having mortgaged your property!

A Smoother Buying Process:

You could secure a property going for a good deal much faster than the investor that would have to wait an average of 30 – 45 days for a mortgage to be approved. Yes, there are private lenders out there that can make it happen faster but not right away. Having cash on your side boosts negotiation power, as the seller does not have to worry about financing costs or a mortgage falling through.No-Risk of foreclosure:

Should the economy hit a downturn, your investment does not become an expense. Since there is no debt involved, you have less of a risk of losing your entire investment to circumstance. You would keep earning the income with less expenditure, and cash flow will stay positive.

IN CONCLUSION

As mentioned before, the decision is up to you whether to do a cash offer vs a financing offer. You have to carefully consider the risks and rewards given your financial situation, goals, and market conditions. There are too many individual factors to cover in this article on how to mitigate risk for your benefit.