What is a 1031 tax deferred exchange?

What is 1031 like kind exchange? And what does it mean for your real estate portfolio?

The point of investing is to grow your portfolio, with the goal of diversifying and increasing wealth. If you’re selling an investment property to accumulate wealth through real estate, then you need to know about the 1031 tax deferred exchange.

Through this procedure, investors like ourselves are allowed to sell and buy similar assets while deferring capital gain taxes. When a sale of a property closes, the seller becomes liable for all kinds of tax based on what the IRS deems as income. In the case of a rental property, there is also recaptured depreciation. And yes, they also want that back.

However, there is light at the end of the tunnel. Increased property acquisition has a direct link to the health of the economy. In this light, the IRS have made some allowances that have assisted those who are investing in property to defer tax liability, or even pay less tax; enabling them to use the immediate proceeds towards their investment goals.

You may have heard about the 1031 Exchange. You may have also heard that it is an intricate undertaking. So, the first step to succeed is to understand the process.

What Is a 1031 Tax Deferred Exchange?

The title comes from Section 1031 of the Internal Revenue Code. This code highlights the exemptions and rules to appropriately avoid paying capital gains taxes, when you sell an investment property and reinvest the proceeds from the sale into real estate within a certain time period.

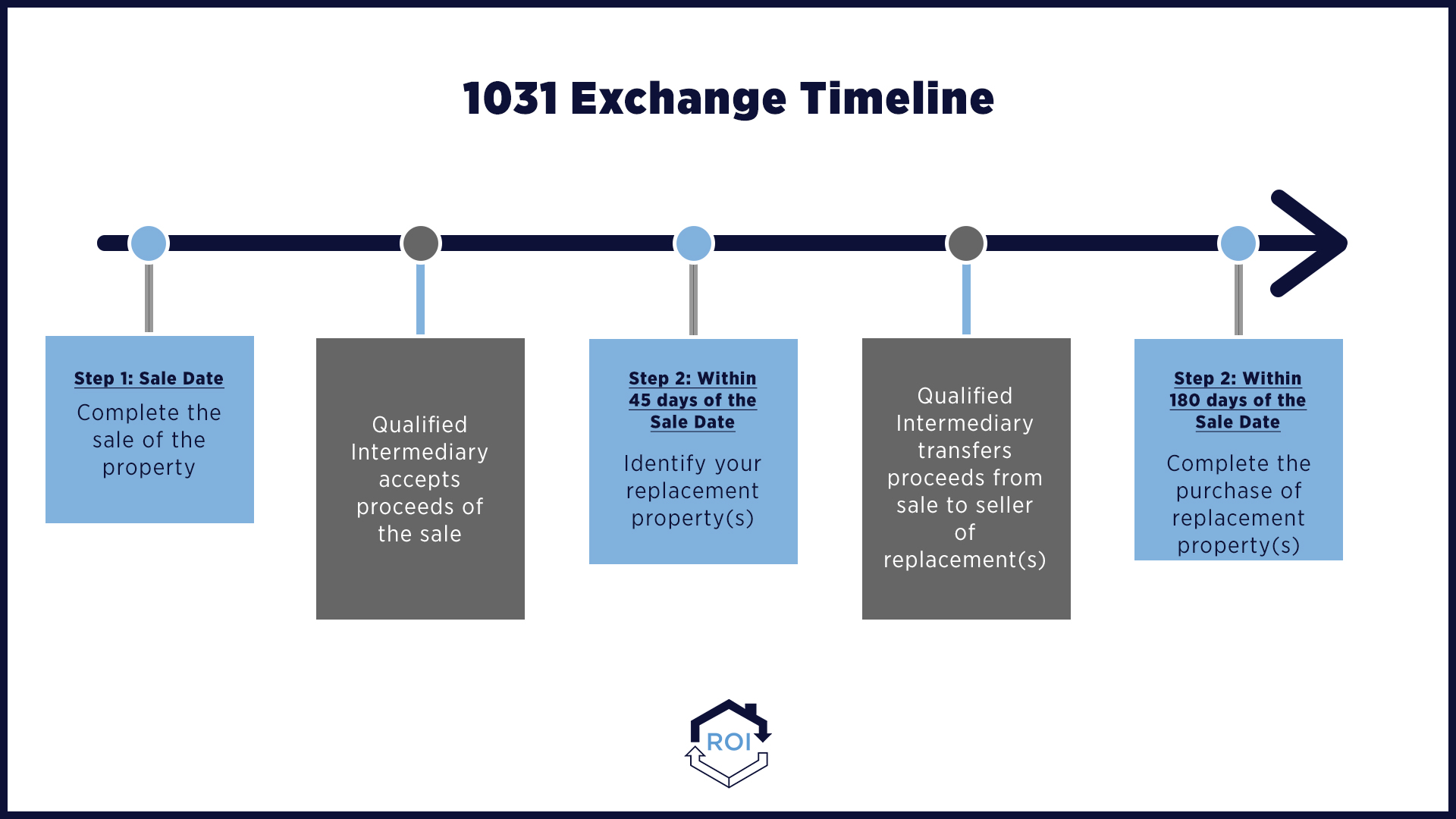

However, a lot of people ignore the fact that you need a qualified intermediary by the IRS to handle the proceeds. Section 1031 states that any proceeds from a sale of real estate remain taxable unless handled by a qualified intermediary, which then transfers the funds to the other seller(s) of the replacement property or properties.

A qualified intermediary is a person like a lawyer or company that is licensed to facilitate the 1031 exchange. The intermediaries hold the funds of the transaction until they can be transferred over to the seller(s) of the replacement real estate. They do not have any formal relationship to any of the two parties involved in the transaction.

When Should You Consider a 1031 Tax Deferred Exchange?

There are a number of reasons why an investor should consider a 1031 exchange. Some of these include:

- You have a property in prospect that could generate a better return or diversify your portfolio to ultimately decrease risk.

- You’re the owner of a self-managed investment property, and you want someone else managing the asset for you.

- You want to consolidate several properties into one, for purposes of estate planning.

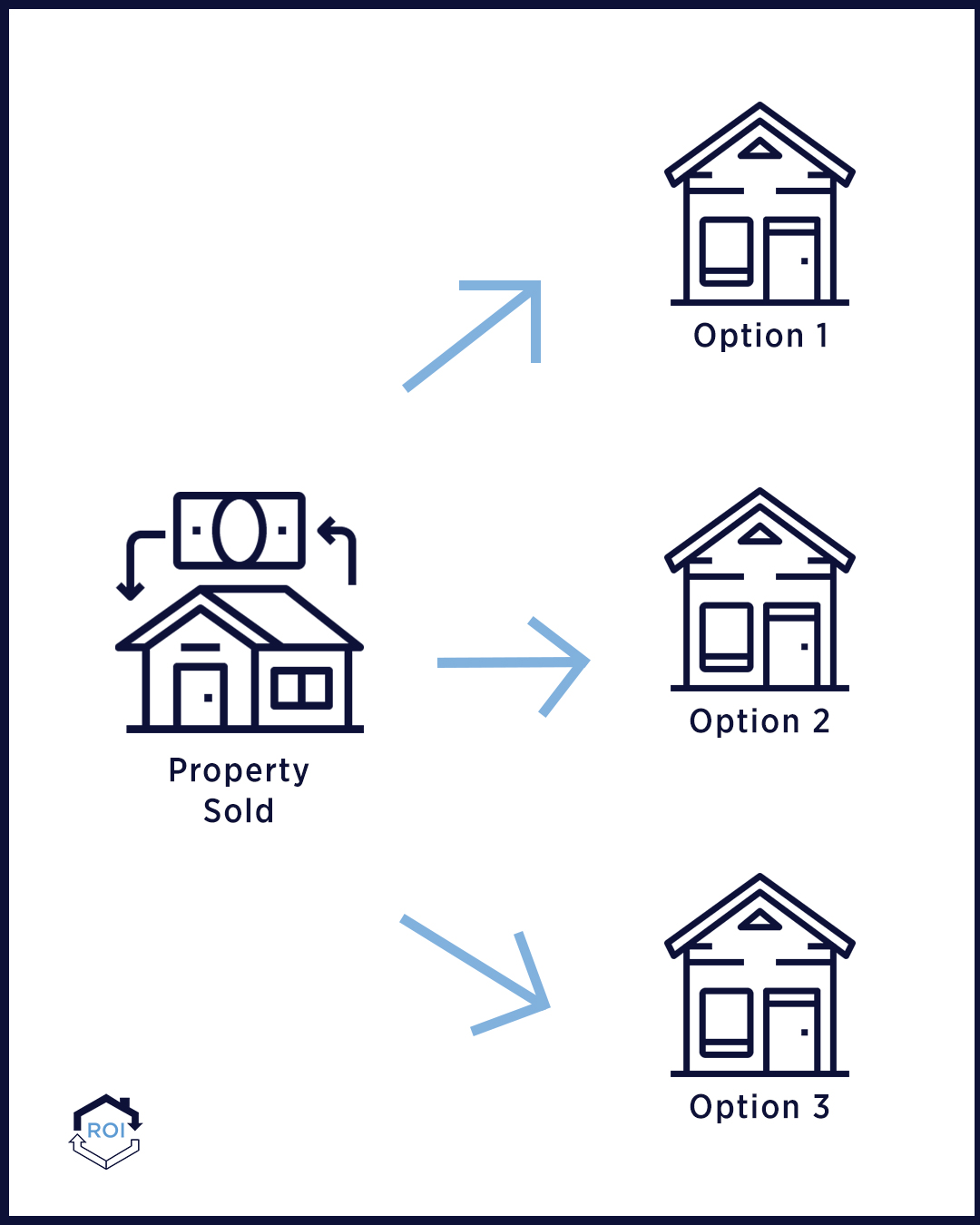

- You want to split up one property into multiple assets.

- Or, reset the depreciation clock (explained below).

Why Proceed With a 1031 Tax Deferred Exchange?

The purpose of executing a 1031 exchange is to defer taxes and have more capital to reinvest into another property. The biggest reward is that, if done correctly, you can accumulate wealth. When the time comes to pay taxes on the capital gains of the future sale for profits, as a retiree, you would most likely be in a lower tax bracket and no longer subject to premature fees.

Taxes Owed In a Normal Sale

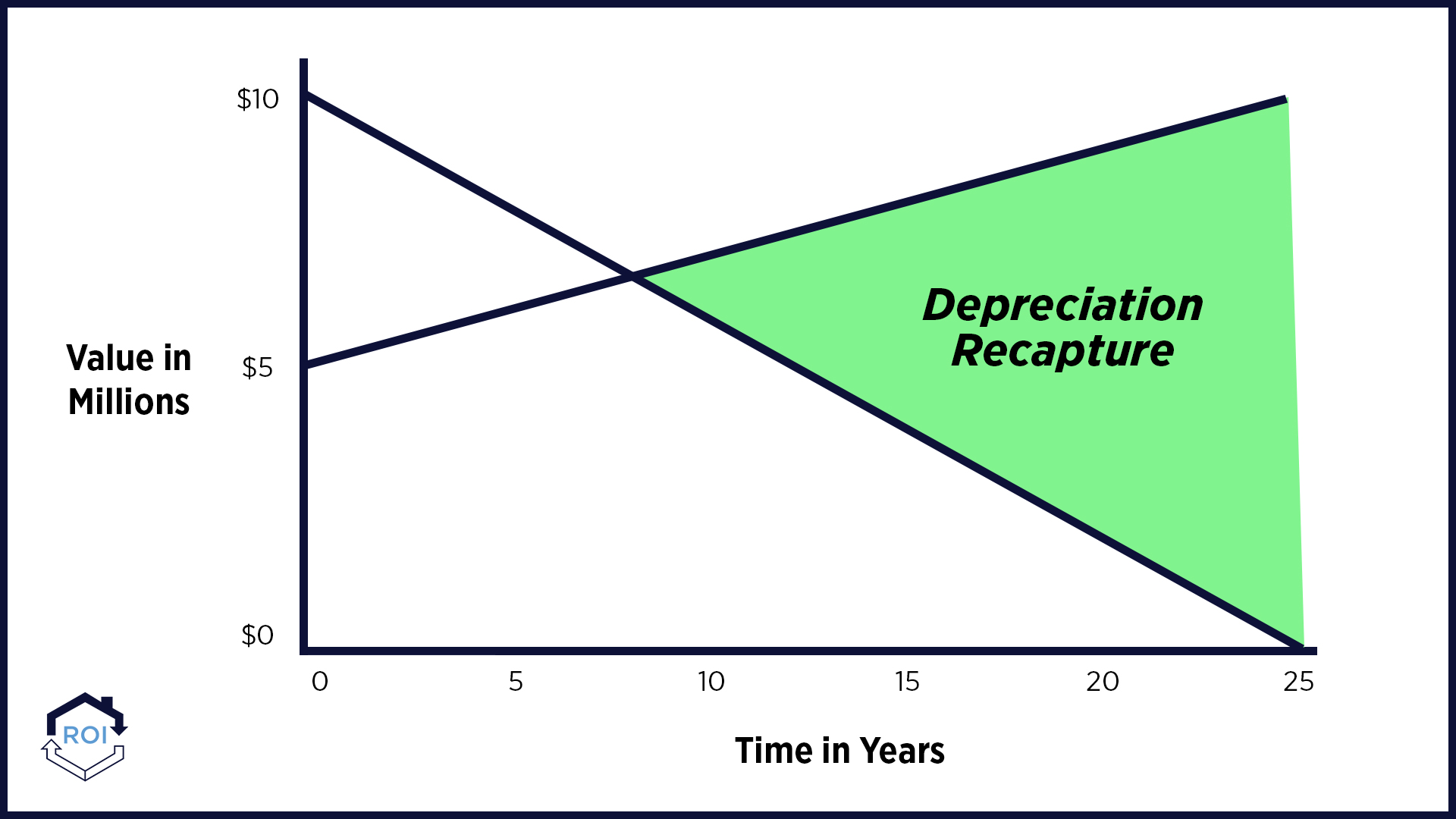

Capital gains tax is the tax liable on any profit made after the sale of your property. Depending on your income, it can range from 15 – 20%. This means that for every $10,000 profit, you are liable for $1,500 – $2,000. This adds up fast, eating into the capital you have available for re-investing in your real estate portfolio. Then there is recaptured depreciation. As you will be aware, a rental property depreciates by 27.5% every year, and this is deductible tax. Once you sell the property, the total deductions are seen as a profit, and subsequently taxed at 25%.

Then… You need to add to this a further 3.8% of net investment tax.

All of this makes no sense when you plan on selling your property with the intention of investing in another one or more.

Depreciation – Where a 1031 Tax Deferred Exchange Plays a Major Role For Many Investors

In the case of recaptured depreciation, because you now own a building that also depreciates, this is no longer taxable as income earned. Instead, depreciation continues. As do tax deductions. Also, instead of your acquired property starting its depreciation anew, your depreciation remains at the level it reached with the sold property.

This scenario makes so much more sense. It leaves you with more capital to boost your investment options. But, there are some rules and restrictions.

The Basic 1031 exchange rules – And Some Twists

There are three basic 1031 exchange rules to understand if you want to qualify for the 1031 exchange. But with every scenario, there may be some factors that come into play.

The Value Of Acquisitions

The value of the property or properties acquired must be equal or of higher value to the property sold, but not higher than 200% of the original value. To avoid unnecessary taxation, use all proceeds towards acquiring the new property. You could always refinance the property a bit later for liquid cash.

Remember that a lesser mortgage is seen as a profit, and therefore liable for tax. Basically, your liabilities must be equal or more in the new acquisition than before, for the tax benefits to apply.

The Three-Property Rule

Allows you to identify three properties as potential purchases regardless of their market value.

The 200% Rule

Allows you to identify unlimited replacement properties as long as their cumulative value doesn’t exceed 200% of the value of the property sold.

The 95% Rule

Allows you to identify as many properties as you like. As long as you acquire properties valued at 95% of their total or more.

The Time Frame

You have 45 days from close of sale to identify a new property. You are allowed to specify three, but only have to choose one. Also, you could buy all three, if this is what you choose to do. From the date of sale of the old property, you have 180 days to close the deal on the new real estate. This leaves very little room for error, much less trial!

The Use Of An Intermediary

The proceeds from the sale must go to an intermediary to hold the funds until the new property is acquired. The intermediary will transfer funds to the new acquisition and, if there is any cash left over, it will be returned to you after the 180 days term.

Tailor The Rules

The principles of a 1031 exchange look great on paper in a perfect world. But as life goes, every scenario has its twists and turns. A 1031 exchange may require a competitive minimum investment and holding time, making these transactions ideal for individuals with higher net worth. However, each investment is unique and the decisions made need to fit the investor’s end goals and vision. Although section 1031 is a good provision to benefit investors and the economy alike, it has some restrictions that could get complicated and trip up the unwary. Therefore, these transactions should be handled by professionals.

Some expenses can be paid with exchange funds. These include:

- Related attorney’s fees

- Title insurance premiums

- Related tax adviser fees

- Finder fees

- Escrow fees

- Broker’s commission

- Qualified intermediary fees

- Filing fees

Expenses that cannot be paid with exchange funds include:

- Financing fees

- Property taxes

- Repair or maintenance costs

- Insurance premiums

What About LLCs?

LLCs are also subject to a 1031 exchange, but only to swap property as an entity. Unless a partner wants to make an exchange and others do not, then, in this case, they would do a drop and swap.

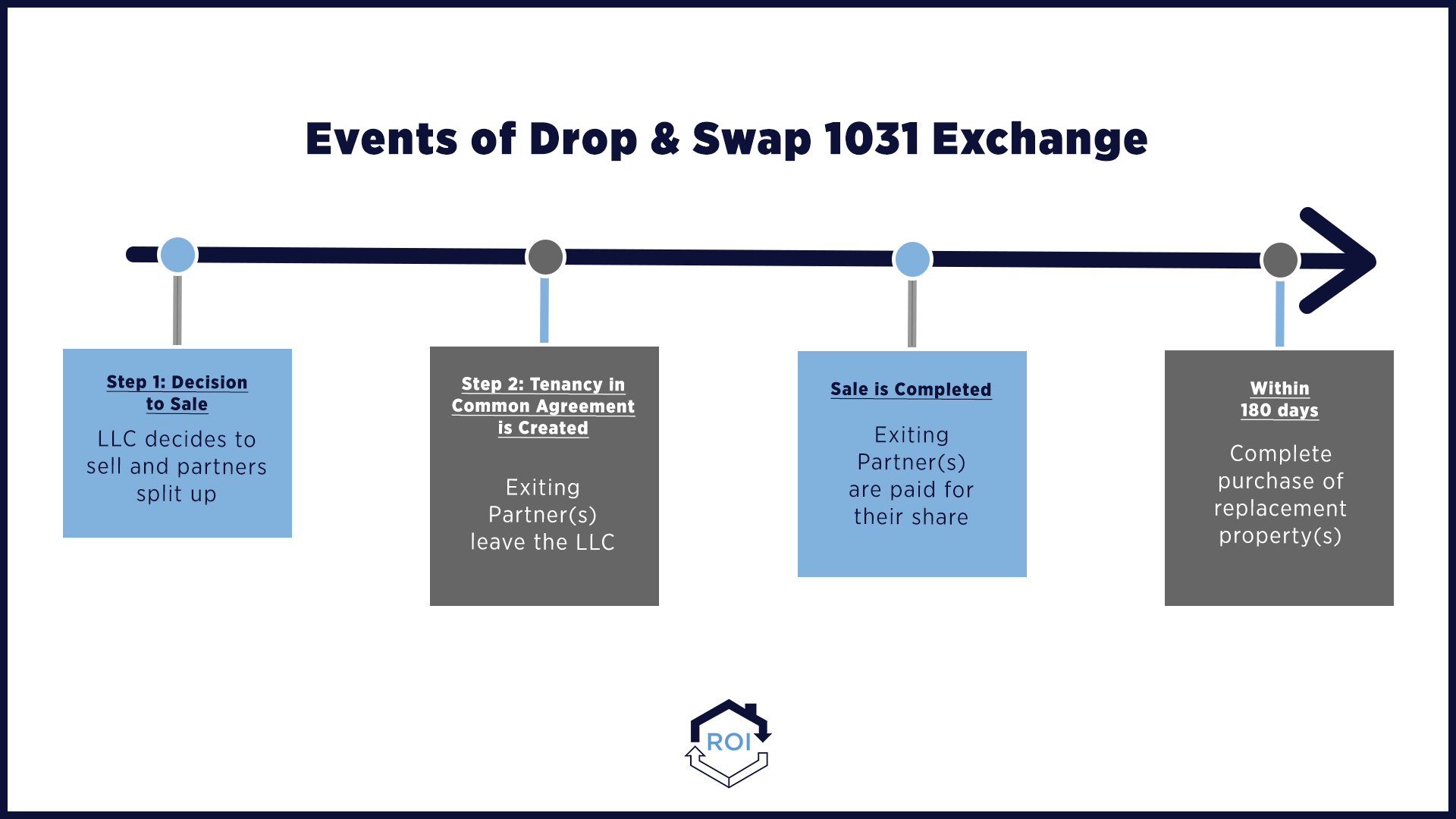

Drop & Swap

Now, there are going to be times when there are multiple partners and one partner wants to do a 1031 exchange and the others do not, that partner can transfer partnership interest to the LLC in exchange for a deed to an equivalent percentage of the property. This makes the partner a tenant in common with the LLC and a separate taxpayer. Once the property owned by the entity is sold, that partner’s share of the proceeds goes to a qualified intermediary, while the other partners receive their shares directly.

However, when the majority of the partners want to take part in a 1031 exchange, the other partner(s) can receive a percentage of the property at the time of the transaction and pay taxes on their shares, while the proceeds of the others go to a qualified intermediary.

Both of these procedures are called “drop and swap” – the most common procedure in these situations.